| |

Dear Friends of HKBN

HKBN Ltd. Debuts on the Main Board of The Stock Exchange of Hong Kong

|

|

| |

| |

HKBN Ltd. (SEHK stock code: 1310), the largest provider of residential fibre broadband services in Hong Kong by number of residential subscriptions, today commenced trading on the Main Board of The Stock Exchange of Hong Kong Limited.

The Global Offering initially consists of a total of 644,866,500 shares, comprising 564,258,500 shares for the International Offering and 80,608,000 shares for the Hong Kong Public Offer, at a price of HK$9.00 per share, subject to the Over-allotment Option. The Underwriters have an over-allotment option to purchase up to 96,729,500 shares, representing approximately 15% of the base offering size.

HKBN’s share listing debut was witnessed at the Hong Kong Stock Exchange by HKBN Talents and valued Friends of HKBN.

Mr. William Yeung, Chief Executive Officer & Co-Owner of HKBN, said, “Today marks a significant milestone in HKBN’s history. As a Company that has proudly contributed an integral component of Hong Kong’s communications backbone by means of our extensive fibre network, we are really proud to be listing in our home market, Hong Kong. We’re excited to embark on the next chapter in our Company’s evolution; we have substantial room to grow our business in both the residential and business segments and look forward to pioneering more disruptive innovations as we do so.”

Mr. NiQ Lai, Head of Talent Engagement, Chief Financial Officer & Co-Owner, said, “Our randomly assigned stock code 1310 happens to be the wavelength of light that travels through our fibre optic network across Hong Kong and is a number that embodies HKBN’s commitment to bring innovative, disruptive fibre technology to empower everyday life. We’re delighted to be marking the beginning of a new chapter for HKBN on such an auspicious note.”

Rothschild is the Financial Advisor. Goldman Sachs (Asia) LLC, J.P. Morgan and UBS AG are the Joint Sponsors, Joint Global Coordinators and Joint Bookrunners. CLSA and HSBC are the Joint Bookrunners, and Bank of East Asia, BNP Paribas and Sun Hung Kai Financial are the Co-Lead Managers.

Click here for a CNBC interview about our listing debut.

Click here for more details about HKBN Ltd.

|

|

| |

| |

Turning a new page in our history warrants a jubilant picture with our HKBN Talents and Co-Owners gathered at the Exchange.

|

|

| |

| |

A mission accomplished courtesy of our professional IPO working team (From left to right):

1. Diana Footitt, Artemis Associates; 2. Sam Kendall, UBS; 3. Catherine Leung, JP Morgan; 4. William Woo, Latham & Watkins; 5. Grace Huang, Freshfields Bruckhaus Deringer; 6. Patrick Leung, HKBN Ltd; 7. Tony Yip, Goldman Sachs; 8 - 16. Eric Ho, Selina Chong, NiQ Lai, William Yeung, Bradley Jay Horwitz, Stanley Chow, Quinn Law, Senior Management & Board of Directors, HKBN Ltd.; 17. Wilson Lee, KPMG; 18. Alexis Adamczyk, HSBC; 19. - 20. Kelvin Chau and Finlay Wright, Rothschild.

|

|

| |

| |

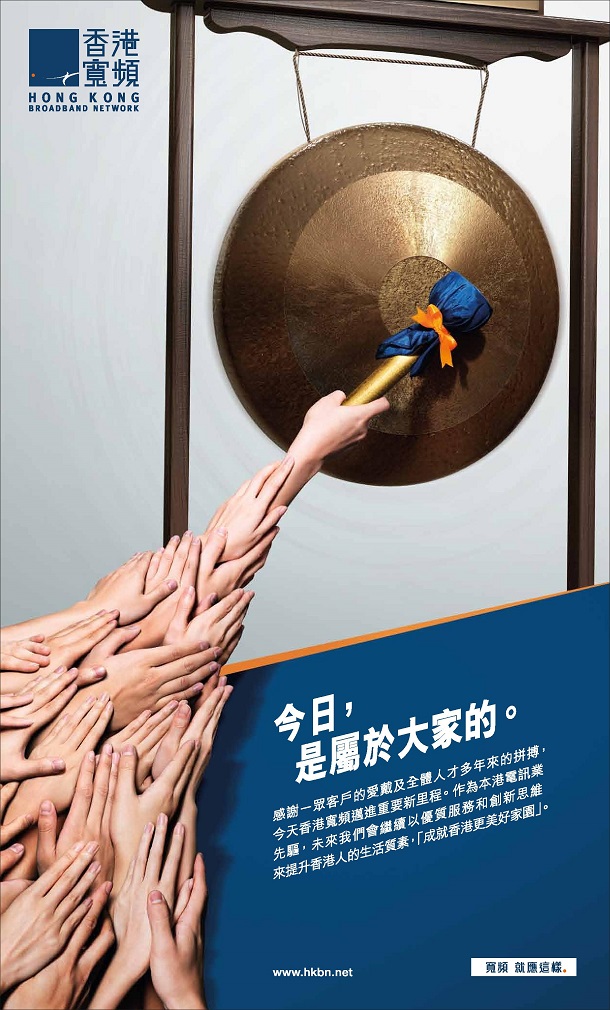

Sharing our achievement to go public, a thank you advertisement was widely circulated across local newspapers to extend tribute to our customers and our Talents.

|

|

| |

| |

Hong Kong Broadband Network Limited |

|

| |

|

|